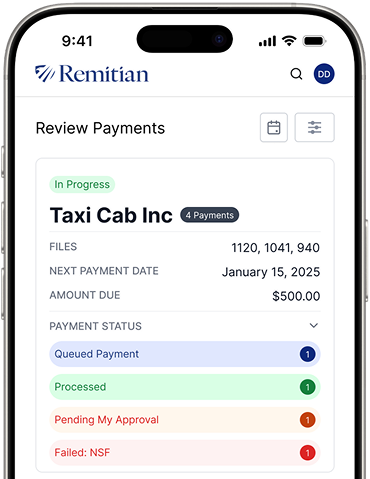

A streamlined, automated tax remittance platform designed to simplify compliance, reduce errors, and give businesses…

In today’s fast-paced world, accounting firms face a growing demand for automation and efficiency. Clients…

In the world of business operations, few things are as universally dreaded as tax compliance….

Recent regulatory changes have created an unexpected compliance challenge for Canadian accounting firms that remit…

Starting a business is exciting navigating taxes shouldn’t be what slows you down.For new entrepreneurs,…

For most of modern history, paying taxes was synonymous with stress, delays, and a whole…

Even though Georgia offers a centralized portal for managing state tax obligations, the process can…

Even though Wisconsin offers a centralized portal for many state tax types, the process is…

The digital revolution has transformed industries worldwide, and tax management is no exception. Digital tax…

Remitian Completes 2022 SOC 2 Type 2 Audit with Zero Exceptions Miami, FL – May…

Once you’re ready to move forward, we guide your firm through a structured, step-by-step onboarding process, from account setup and client import to team training and go-live. The adoption journey is fully supported, tailored to your workflows, and designed to help your team transition with confidence and minimal disruption.